If you’re a working professional saving for retirement, chances are most of your wealth is tied up in your 401(k). But one of the biggest questions we hear from clients is:

“Should I put money in a Traditional 401(k) or a Roth 401(k)?”

The truth is, both accounts are powerful tools — but the right choice depends on your income, tax situation, and future goals.

________________________________________

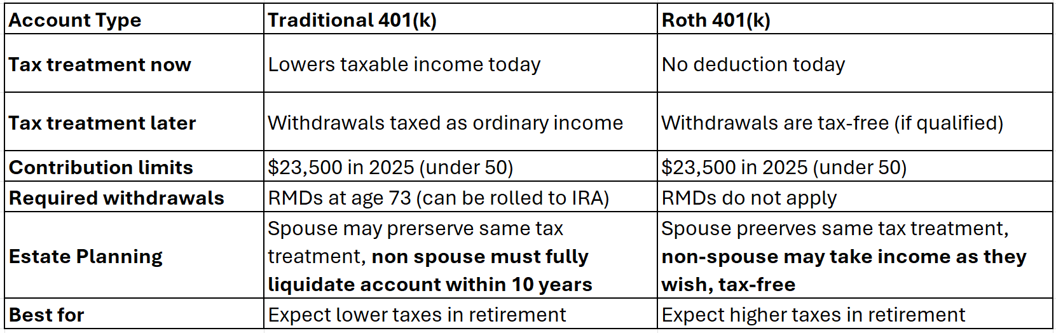

• Contributions: Made with pre-tax dollars

• Taxes: You get a tax deduction today, but every dollar you withdraw in retirement is taxed as ordinary income

• Best for: High earners who expect to be in a lower tax bracket when they retire

• Contributions: Made with after-tax dollars

• Taxes: No tax deduction today, but withdrawals (including growth) are 100% tax-free in retirement

• Best for: Younger professionals or those who expect higher income/taxes in the future

________________________________________

________________________________________

There’s no one-size-fits-all answer to the Roth vs. Traditional 401(k) debate. The best strategy depends on:

• Your current income and tax bracket

• Expected retirement lifestyle and expenses

• How much flexibility you want in the future

A thoughtful mix of both types of accounts often gives you the most control over your retirement tax picture.

Integra Wealth is a fee-only, fiduciary financial advisory firm located in Cary, NC & Chattanooga, TN.

As we head into the final weeks of the year, it’s a great time to pause, look over your financial picture, and make sure you’re not leaving opportunities, or IRS penalties, on the table. Here are a few simple but important year-end planning items to review.

Choosing to retire is one of the most important decisions someone can make in their lifetime. Read this article to learn about all the things you should consider prior to making this life-changing decision.

Stock pickers underperform the market long-term. Learn why diversification and disciplined investing still win.